Industry-Leading private money & dscr loans

No paystubs, tax returns, employment verification, PFS, or personal debt ratio calculations – just faster closings and greater opportunities.

Allow us to finance your reserves to waive off bank statements and make your loan payments for you. See if you qualify today!

Take 3 minutes to request a term sheet or proof of funds letter by clicking on one of the 5 loan types below. You can also read my reviews, book a call or send me a call, text or email 👇

Real Estate Investment Financing Made Simple

Private Money Lender, Licensed Agent & Sales Manager

With 20+ years of experience and an estimated $2.5 billion in client transactions, I specialize in helping residential real estate investors, brokers, loan officers, realtors and licensed lenders build wealth.

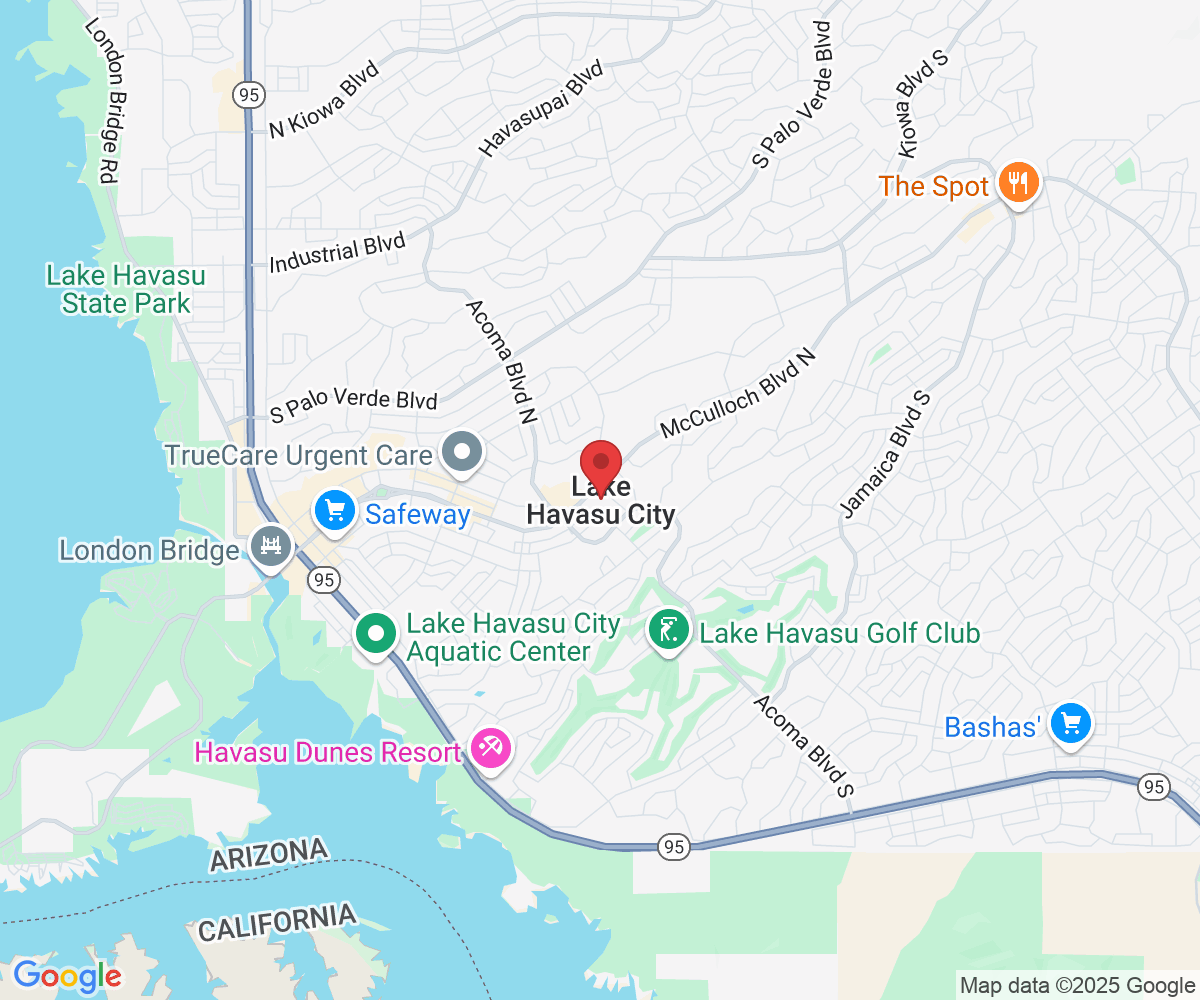

Based in Lake Havasu City, Arizona I offer Private Money (No Income Fix and Flip, Construction, Bridge) and DSCR 1st mortgages in 47 states, with several very unique niches for ideal cash flow and first mortgages typically exceeding $500,000.

If you are a professional in this space, or just starting out, I invite you to apply for a loan using the questions above and join one of my evening webinars designed to help you navigate the real estate market with confidence.

For those interested in brokering Private Money and DSCR 1st mortgage loans, I also offer a specialized webinar. Upon completing the training, you’ll have the opportunity to apply to broker private funding from Temple View Capital in your market.

And finally, if you'd like to deliver loans via true Table Funding or Correspondent and you fund more than $12 million per year with our competitors, send me an email to learn the benefits of our TPO channel.

- Kirsten VanderJagt

Frequently Asked Questions

What documents are needed to get a loan?

You’ll need our simple PDF loan application and disclosures, stamped articles of formation for your new or seasoned LLC, LP or Corporation, an operating agreement or bylaws which you can amend, property insurance, a credit report, title report and appraisal. I will order these last 3 items for you. You do NOT need proof of personal or business income, a personal financial statement, tax returns, and we do not ask about your employment. In many cases, you do not need seasoned assets or bank statements. Specific requirements vary by program.

If you are doing new construction, a renovation or bridge loan with improved pricing or higher loan amounts, we may ask for a track record and a scope of work / budget if it applies. Please obtain your scope in writing from a licensed and insured contractor or subcontractor as per the city or state.

How quickly can we fund the loan?

COE is realistically about 15 business days: est. 5 days for appraisal and title, est. 5 days for underwriting and final loan terms, est. 5 days for legal documents and wire. Please be sure everyone is on board with this timeline. On a purchase, you could write the offer as 10-15 days and keep a 10-15 day extension in mind because Realtors deal in calendar days and lenders deal in business days.

Testimonials

Kirsten is a terrific underwriter who has the ability to work under pressure ensuring loans close on time. Her exceptional communication skills ...clear and precise conditions makes the process seamless ...no doubt an industry veteran.

— Rhys Morris

I wanted to take a moment to express my admiration and appreciation for Kirsten’s exceptional work ethic and dedication. Throughout our time working together, I have been consistently impressed by her professionalism.

— Rolethia Scott

I've had the distinct pleasure of getting to know Kirsten through real estate. Not only is she incredibly intelligent, she has integrity, natural leadership skills, and is driven to ensure the best outcome possible.

— Lisa Marie Quinn

TEMPLE VIEW CAPITAL FUNDING, LP™ 2016 is licensed (i) by the Financial Division of the California Department of Business Oversight as a California Finance Lender and Broker under DBO license #60DBO-73498, (ii) by the Department of Financial Institutions of Arizona as a Arizona Mortgage Banker under License # BK-1004278, (iii) in Minnesota as a Residential Mortgage Originator under License #MN-MO-1835832, (iv) maintains its Residential First Mortgage Notification status in Utah through the Utah Department of Financial Institutions, (v) by the Division of Financial Regulation of Oregon as an Oregon Mortgage Lender under License # ML-5871 and (vi) by the Nevada Division of Mortgage Lending as a Mortgage Company Licensee* under License # 5168. *It should be noted that in the state of Nevada some of Temple View Capital Funding, LP’s services may not be available to Nevada customers.

*Rates, terms and conditions offered apply only to qualified borrowers in accordance with our guidelines at the time of application, property factors and geography and are subject to change at any time without notice. This is a non-binding expression of interest and does not create any legally binding commitment or obligation on the part of Temple View Capital Funding, LP or its affiliates and are subject to our credit, legal and investment approval process. Rates and terms are as of 11/15/25. Some of the links in this post are affiliate or joint marketing links and Temple View may earn a commission. Our mission remains to provide valuable resources and information that helps real estate investors finance and manage their investment properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission. By clicking our links you agree to receive marketing material by us or our affiliates and joint marketing partners.